From the rise of green bonds to Vietnam’s bold push for climate-aligned banking, sustainable finance is transforming how we invest, lend, and grow. With ESG assets set to surpass $53 trillion by 2025, the financial world is waking up to a powerful truth: profit and purpose can go hand in hand.

Yet, what is sustainable finance? How has it developed throughout the years?

“At Goldman Sachs, sustainable finance is a core competency – a better way of serving our clients, driving innovation, and advancing sustainable economic growth."

Kyung-ah Park, Head of Environmental Markets & Innovation, Sustainable Finance Group, Goldman Sachs

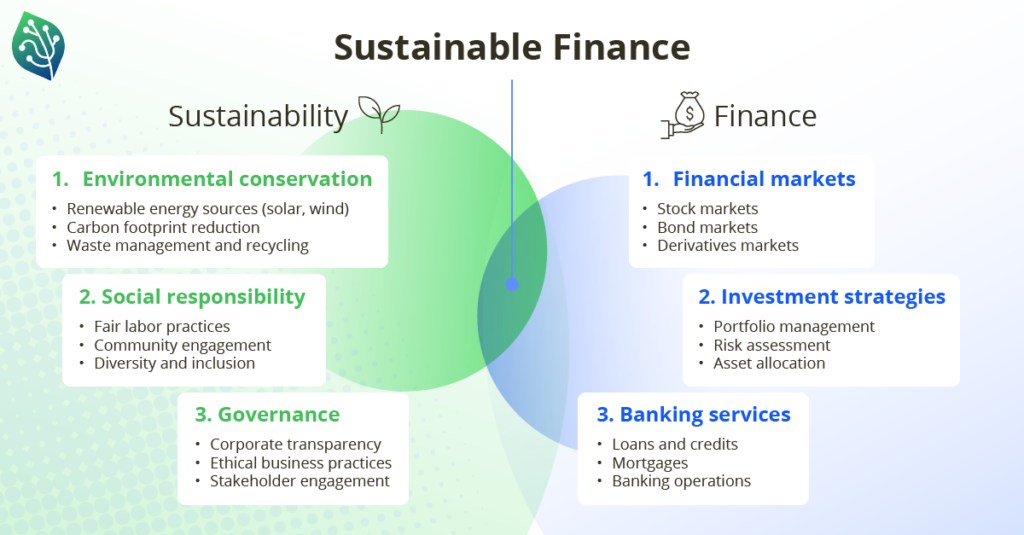

Sustainable finance encompasses the integration of environmental, social, and governance (ESG) considerations into financial services and investment decisions. This practice not only aims to promote long-term environmental stewardship and social equity but also seeks to offer substantial economic growth through investments in sustainable economic activities and projects. As of 2020, global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total global assets under management.

Early Beginnings in the 1960s: This era marked the initiation of the modern environmental movement, with events like Earth Day and the publication of Rachel Carson’s “Silent Spring” highlighting the impacts of pollution and the indiscriminate use of pesticides.

Moreover, in 1992, the Earth Summit in Rio de Janeiro established the United Nations Environment Programme Finance Initiative (UNEP FI), recognizing the crucial role of private finance in sustainable development. Thirty years later, UNEP FI’s members are pioneers in the finance world, driving transformations toward a system that supports sustainable development.

For Vietnam, the progress includes the State Bank of Vietnam’s approval of a program on green bank development and an action plan aligned with the nation’s sustainable development goals for 2030. By 2025, Vietnam aims to have an environmental and social (E&S) management system in all financial institutions and integrate E&S risk assessments into their credit risk assessments. This commitment is demonstrated by a 2019 survey revealing that 76% of banks had a sustainable finance strategy in place, with several banks already implementing E&S systems to meet regulatory requirements.

In the broader context of Southeast Asia, efforts to shift towards sustainable financial systems are being supported by initiatives such as the ASEAN-5 economies’ transition to low-carbon and climate-resilient economies. This includes a significant push towards climate change mitigation and adaptation, emphasizing the critical role of the financial sector in supporting these goals.