Navigating ESG Reporting Standards: A Comprehensive Mapping Guide

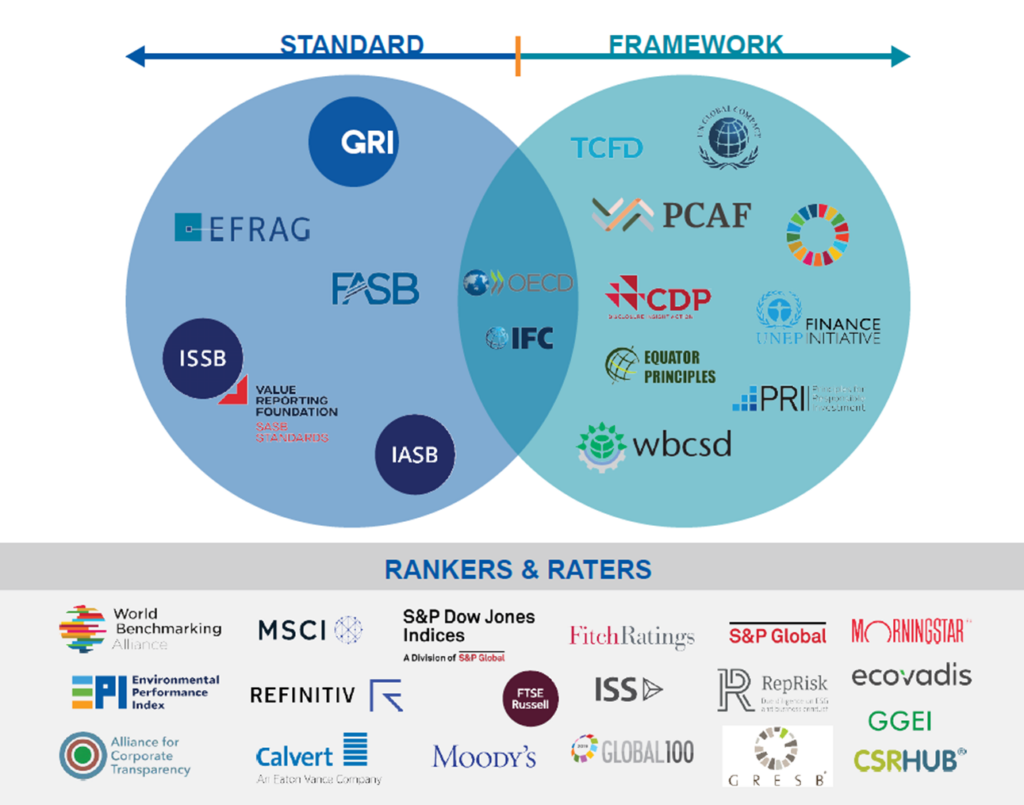

Knowledge Hub Environmental, Social, and Governance (ESG) reporting is crucial for sustainable business practices globally. As stakeholders demand greater transparency and accountability, navigating the complex landscape of ESG standards becomes more challenging. This article explores the ESG Reporting Standard Mapping, emphasizing its necessity and the strategic integration across diverse frameworks. Table of Contents The Importance […]

Over 239 Companies Projected to Miss Net Zero Targets, Reports GreenBiz

Knowledge Hub Since its inception in 2019, over 1,000 companies have signed up for the Business Ambition for 1.5C Campaign. However, the road to carbon-neutral and sustainable production remains rocky. Among the 971 corporates analyzed in a recent study by the Science Based Targets Initiative (SBTi), which assesses companies’ progress in setting and implementing climate […]