Environmental, Social, and Governance (ESG) reporting is crucial for sustainable business practices globally. As stakeholders demand greater transparency and accountability, navigating the complex landscape of ESG standards becomes more challenging. This article explores the ESG Reporting Standard Mapping, emphasizing its necessity and the strategic integration across diverse frameworks.

In an era defined by climate crises and social upheavals, ESG reporting offers stakeholders vital insights into a company’s sustainability practices and risks. With Vietnam needing an estimated USD 368 billion to achieve its net zero goals, transparent ESG disclosures become essential for mobilizing sustainable financial resources.

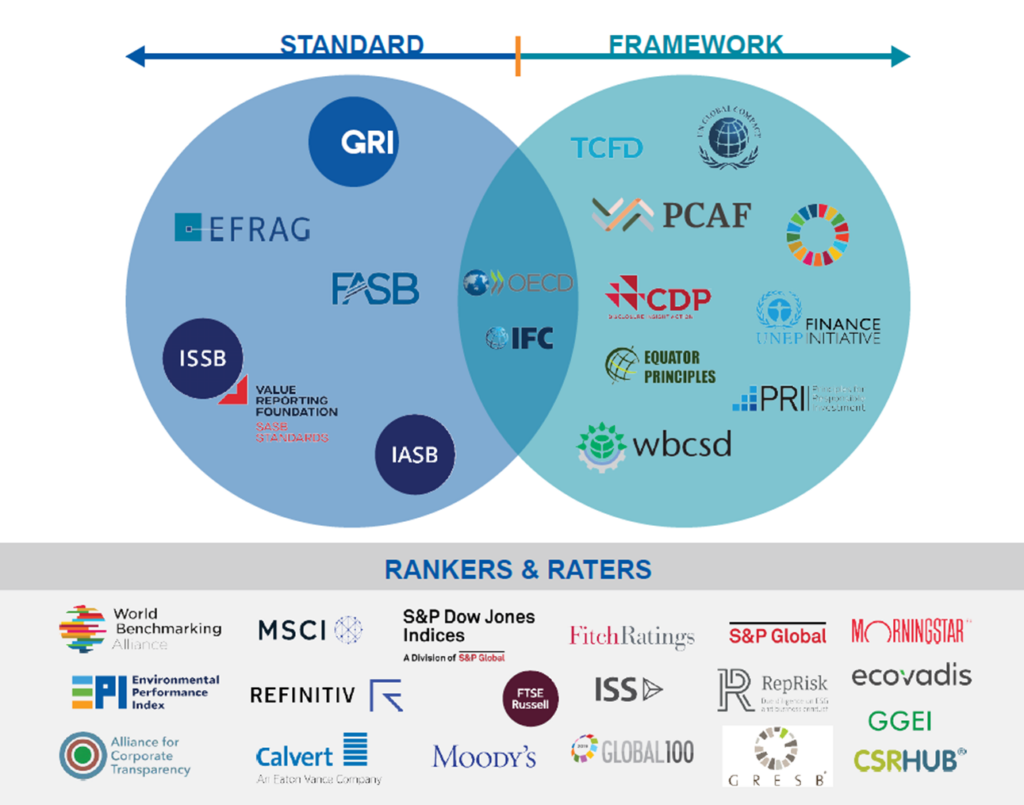

Source: GRI

Organizations face multiple challenges in ESG reporting, including inconsistencies across standards and the high costs associated with data collection and reporting. The lack of standardized frameworks leads to difficulties in comparability and reliability of ESG disclosures.

Nestlé, a leading food and beverage company, aligns its reporting with GRI and SASB standards, boosting stakeholder trust and streamlining sustainability efforts, underscoring their commitment to addressing environmental and social responsibilities transparently. In Europe, 82% of top companies now produce sustainability reports, reflecting a sharp increase from previous years (KPMG, 2022).

The future of ESG reporting is trending towards greater integration and standardization. Initiatives like the International Sustainability Standards Board (ISSB) aim to provide a global baseline of sustainability-related disclosures, simplifying the reporting process for companies operating in international markets.

ESG Reporting Standard Mapping is not just about compliance; it is a strategic tool that enhances transparency, informs better investment decisions, and fosters sustainable business practices. As regulations evolve and stakeholder demands intensify, adeptness in navigating these standards will be crucial for business success.