Introduction

Southeast Asia’s evolving landscape melds environmental, social, and governance (ESG) factors with financial dynamics. The region’s vulnerability to natural disasters propels a surge in sustainable finance initiatives.

ESG Progress in Southeast Asia

While prioritizing rapid economic growth, Southeast Asia grapples with carbon-intensive activities that exacerbate climate change. Initial ESG strides in the region emphasize environmental concerns in policies and regulations. Over the past five years, Asia-Pacific has witnessed a doubling in ESG policies, aligning corporate disclosure with or even surpassing US standards, as reported by Goldman Sachs.

Transitioning towards ESG Principles

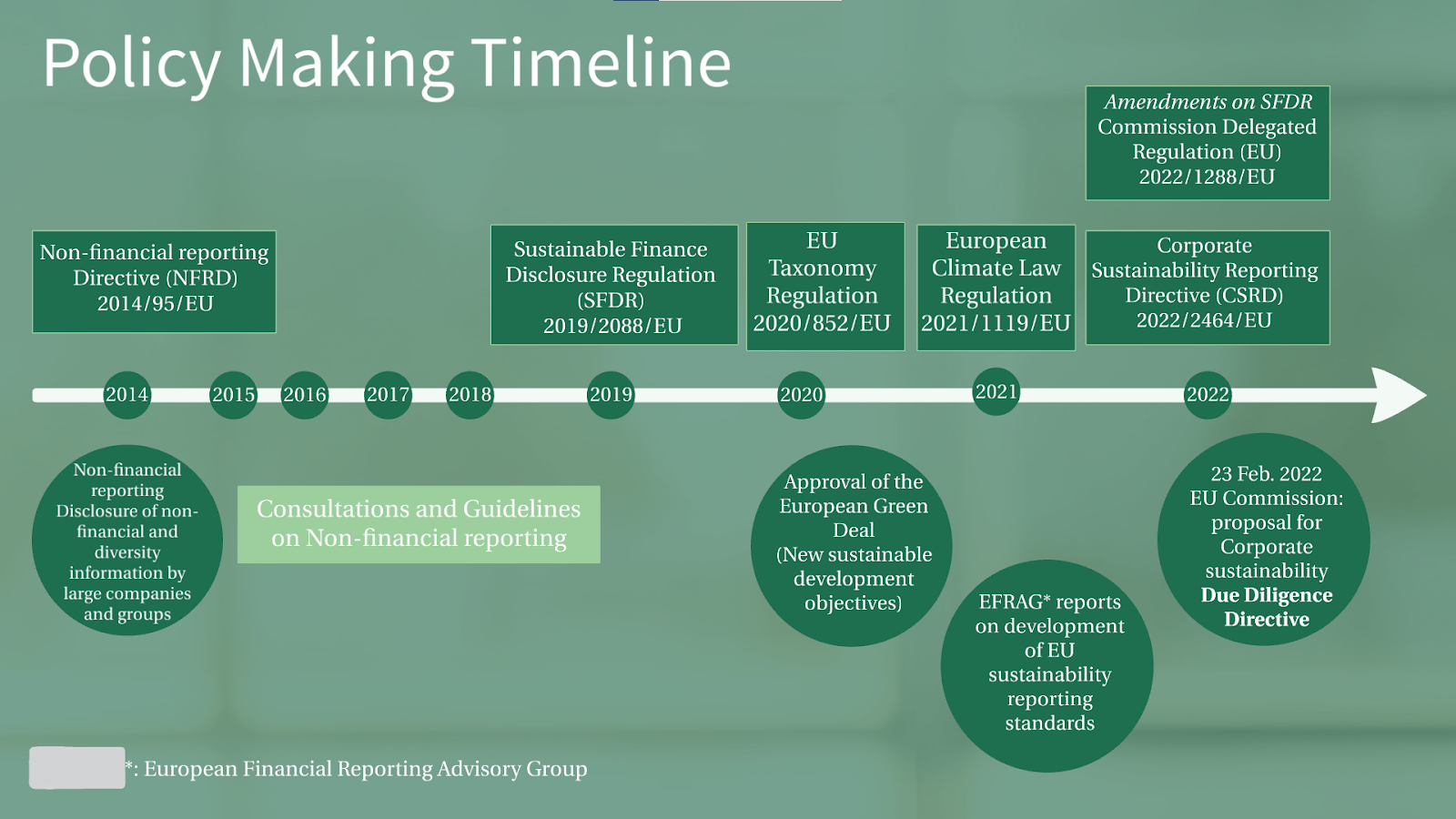

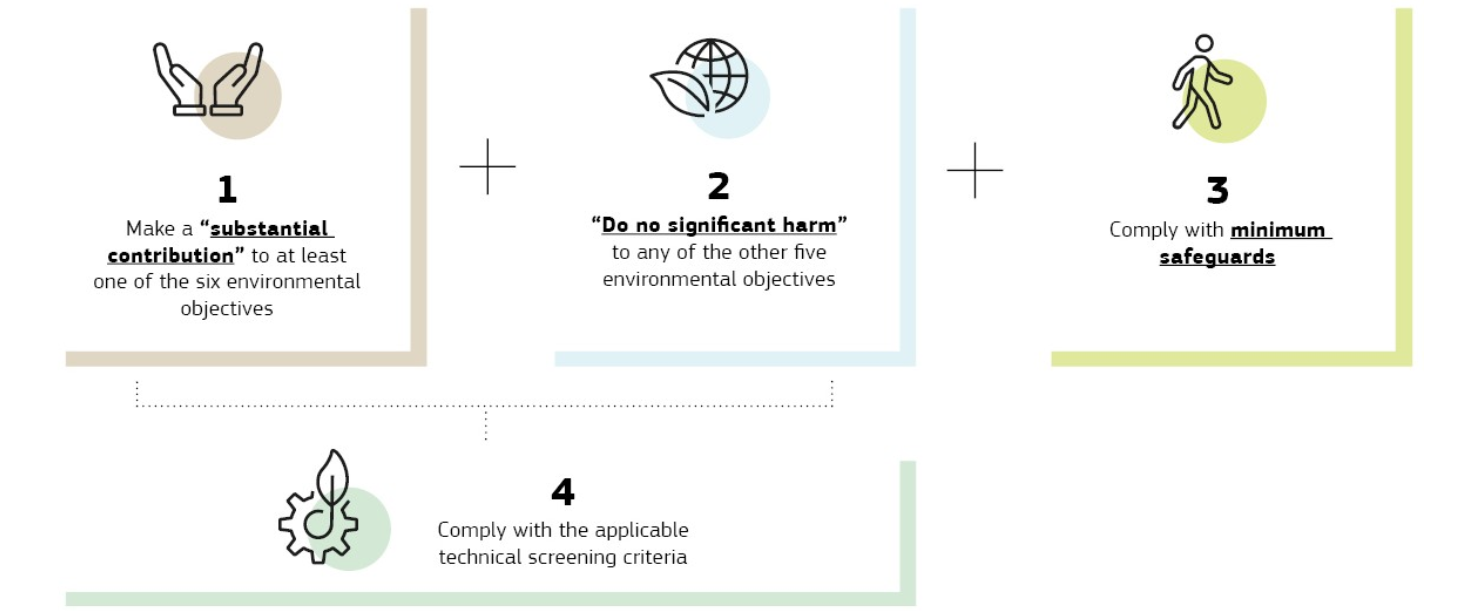

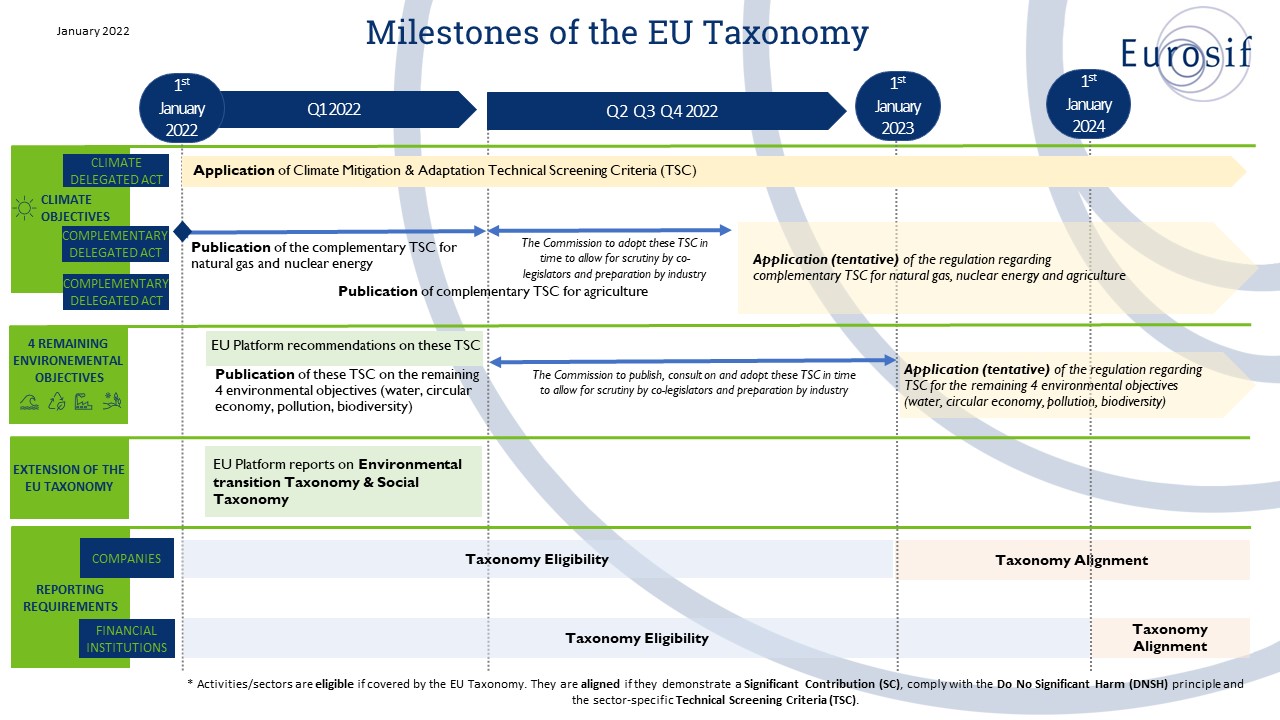

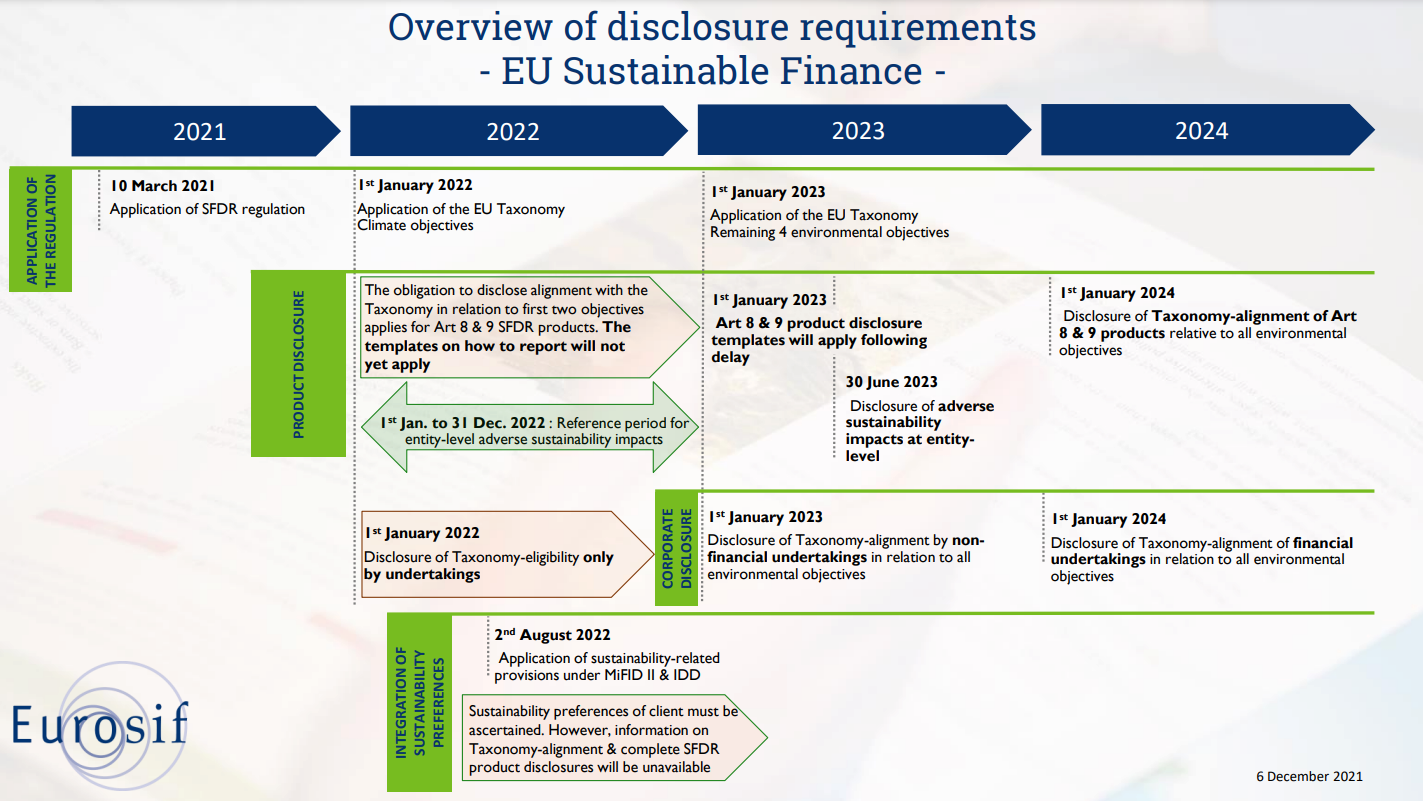

Learning from European advancements, Southeast Asia now pivots towards ESG disclosure, climate risk mitigation, and decarbonization. Despite varying institutional maturity, ASEAN’s unified sustainable finance taxonomy and specific country frameworks in Malaysia and Indonesia signal a collective approach.

The Rise of Sustainable Finance

Forecasts predict a surge in sustainability-related policy developments. In 2023, there was a 40% increase in green finance development compared to 2022. Governments lead the charge, with corporations and small to medium-sized enterprises anticipated to follow suit, thus shaping a financial landscape increasingly influenced by ESG imperatives in Southeast Asia.

Looking Ahead to 2024

The forecast for green finance in 2024 remains promising, showcasing a global commitment to sustainable investments. Projections indicate a significant uptick of over 20% in green finance activities from the previous year. The estimated value of green bonds issued is expected to surpass $300 billion, reflecting heightened funding for eco-friendly projects.

Embracing Green Finance Initiatives

Governments, corporations, and financial institutions are poised to further embrace green financing initiatives. Regulatory requirements and an increasing realization of the economic benefits tied to sustainable practices drive this momentum. The forecast underscores an ongoing shift towards aligning financial strategies with environmental objectives, fostering a more resilient and environmentally conscious global economy.

Conclusion

Southeast Asia is primed for a surge in green finance, marking a pivotal moment in adopting ESG principles to construct a more resilient and eco-conscious economy in 2024.

Source: Sustainable Fitch, KPM

Check out our Knowledge Hub for more insightful articles.

Source: Sustainable Fitch, KPMG