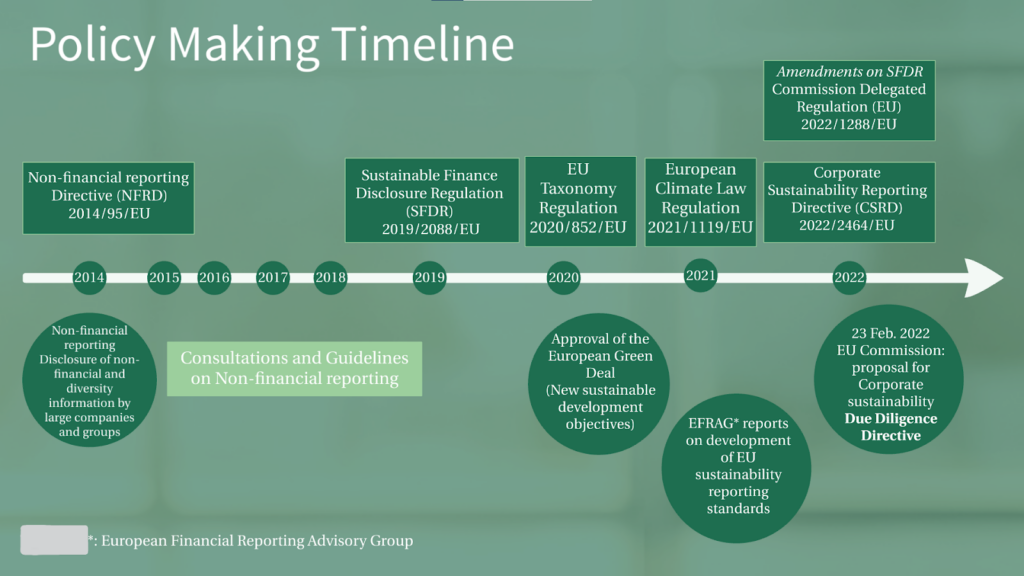

Relevant Legislation:

Almost 50,000 companies expected to be impacted by CSRD (three quarters of business in the European Economic Area).

CSRD will apply to:

Reports must cover:

Application of CSRD in 4 stages:

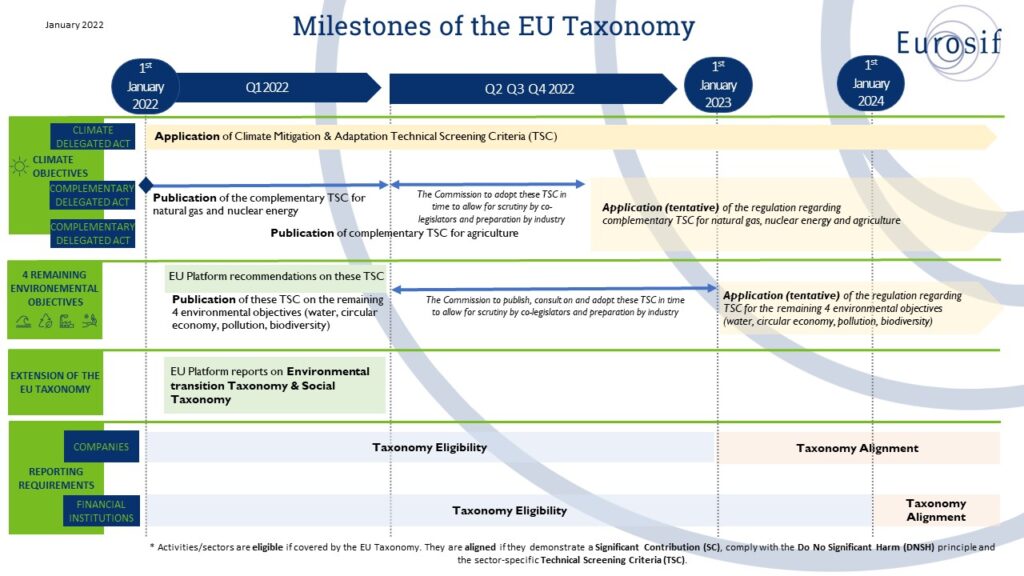

The Taxonomy Regulation established 6 objectives for European companies and some third-countries companies active in Europe to follow:

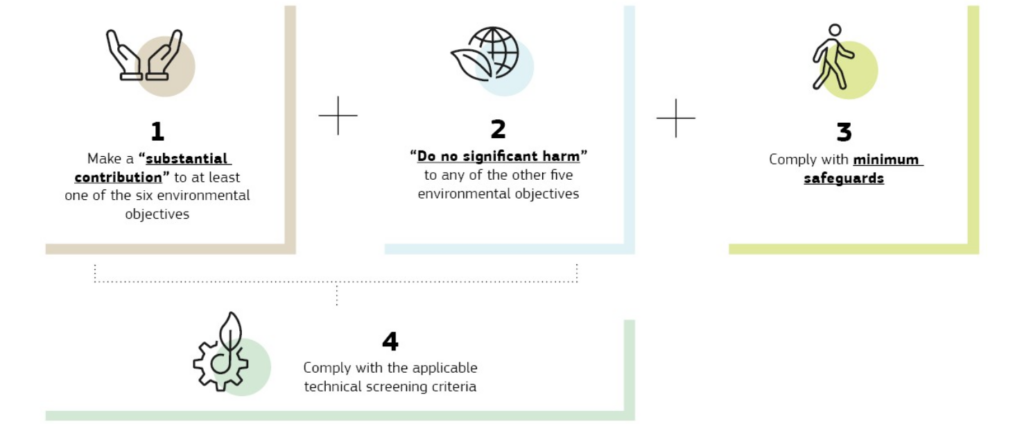

The Taxonomy Regulation allows to assess the companies’ performances towards the above objectives through 4 criteria:

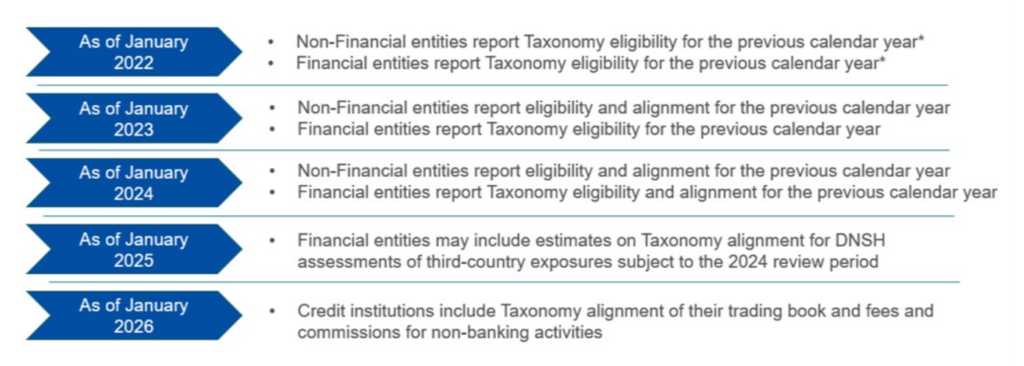

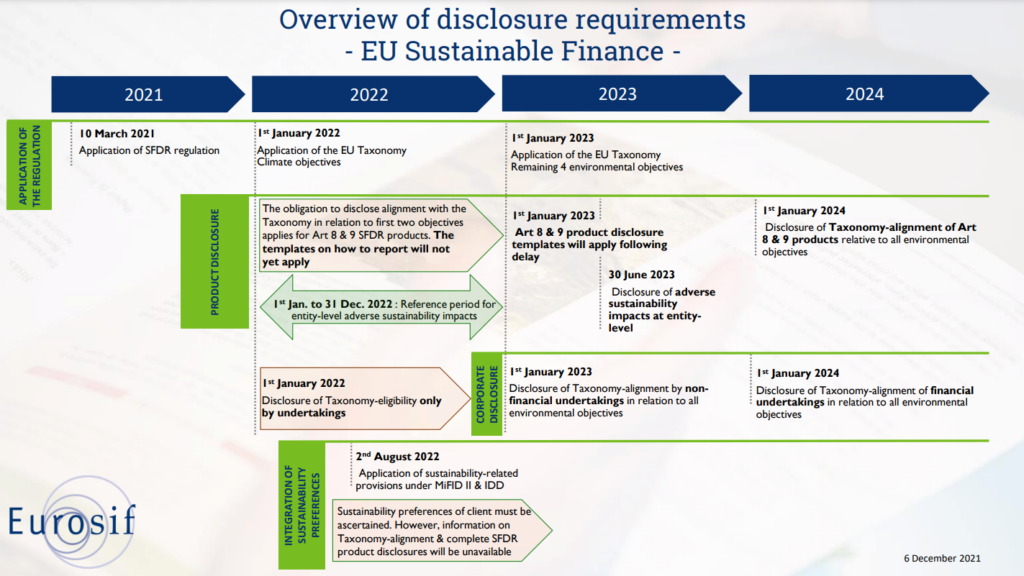

The Taxonomy Regulation will be implemented in Europe according to the following timeline:

SME and micro-companies are exempt from this.

European Parliament needs to approve the proposal.

Once adopted, Member states have 2 years to transpose it into national law.

Corporate due diligence duty:

Enforcement: