When first discovering carbon credits and understanding how the market works, questions naturally arise about the ethical implications behind it. Given that the companies buying carbon credits are typically high-pollution industries, it might initially seem that the Voluntary Carbon Market (VCM) provides an easy way for them to bypass implementing sustainable practices by simply purchasing carbon credits. Which raises an important question: How can making profits from carbon removal projects be ethical?

By exploring the reality of the VCM, its origins, how it functions, and the companies involved, we can begin to see that business and ethics can indeed work hand in hand. This article will dive into the overarching goals behind the market, the types of companies that profit from the market, and how it provides opportunities for developing countries to generate new economic growth.

The ultimate goal of the VCM is to help companies and countries achieve Net Zero emissions. Net Zero refers to the balance between the amount of greenhouse gases emitted and the amount removed from the atmosphere. Achieving this goal is crucial to limit global warming to 1.5°C, as outlined in the Paris Agreement.

The VCM plays a key role in reaching this goal by providing a mechanism for companies to offset their emissions and invest in carbon removal projects that align with Net Zero targets. While companies should prioritize direct emissions reductions, the VCM offers an essential tool for compensating for unavoidable emissions, ensuring that they are still contributing to global climate goals.

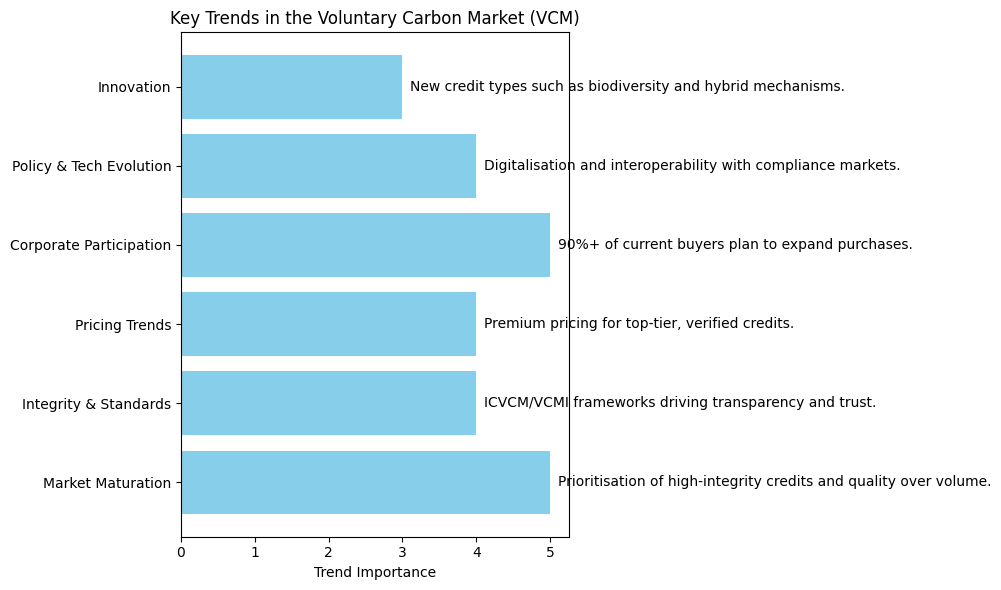

International regulations and treaties like the Paris Agreement and EU Emissions Trading System (ETS) emphasize the need for carbon markets and offsetting mechanisms to help reduce emissions globally. Because of these regulations and their aim to see concrete results from VCM investments, tendencies have changed.

When the beginning of this market was poorly regulated, the accuracy of the quality of the issued carbon credits wasn’t reliable, some companies were accused of greenwashing for claiming carbon removals that were not accurate. Right now tendencies are changing favorably towards high-quality carbon credits purchase to meet international requirements.

The ethical use of carbon credits and offsets claims is looked closely by governments, international regulations and even the consumers themselves, which obliges buyers to pay real attention to the projects they invest in and don’t allow them to claim poor/fake carbon offsets anymore.

The VCM functions on a system where high-emission companies are required to purchase carbon credits to offset their own emissions. These credits are essentially a way for companies to claim they have “removed” carbon from the atmosphere. While this could be seen as companies “getting away” with environmental regulations, there is a significant upside: the funds generated are funneled into companies actively removing CO2.

This system creates investment opportunities for smaller, environmentally focused companies that can leverage these funds to develop further carbon removal projects. As these companies grow, they contribute to the reduction of CO2 in the atmosphere, achieving both business and environmental goals.

For example:

These examples show how large companies are providing vital opportunities for SMEs to scale their operations, contributing to the global reduction of CO2.

Additionally, the VCM’s structure has created new opportunities for consulting firms, such as Aquila, that help these SMEs with financing and generating carbon credits. The demand for expert guidance has grown as more companies aim to meet sustainability goals, demonstrating how the market has opened doors to new business models and careers in consulting.

Carbon Clean Solutions, a leader in providing CO2 capture technologies, has significantly grown due to investments in carbon removal projects through the VCM. The company’s carbon capture as a service technology is now used in industries ranging from cement to chemicals. By utilizing carbon credits, Carbon Clean attracted major investors like Chevron and Shell, which enabled them to expand their operations and develop new carbon capture technologies. These investors not only purchased carbon credits from the projects but also provided capital funding, helping the company grow into a global leader in carbon capture technology.

This example illustrates how the VCM doesn’t just offer companies a way to offset emissions, it also opens doors for SMEs to attract investment, scale their innovations, and contribute to the reduction of global carbon emissions.

The companies that benefit from VCM investments are often deeply rooted in environmental and social responsibility.

For instance, methodologies developed by Verra and Gold Standard include social requirements alongside environmental goals, ensuring that projects benefit local communities, including opportunities for women and disadvantaged groups. This dual focus on both environmental and social ethics is what separates true impact from greenwashing.

These examples illustrate that many projects funded by carbon credits are genuinely contributing to both environmental sustainability and social progress.

The VCM presents significant opportunities for developing countries to generate new sources of economic growth. In Southeast Asia (SEA), for instance, countries are witnessing a boom in carbon removal projects due to their pressing need to address high levels of pollution. The VCM’s additionality requirement ensures that funds are directed towards projects with real, measurable impact.

The additionality principle ensures that carbon credits are only issued when the project would not have occurred without the carbon financing. This prevents overproduction and consumerism from taking center stage, forcing the market to focus on projects that genuinely need funding.

For example, Southeast Asian countries with large deforested areas or reliance on coal power are now attracting investment for reforestation projects or renewable energy installations. This is creating new job opportunities and economic growth, especially in rural regions where development has been limited.

By integrating local communities and sustainable development practices, the VCM allows these countries to be significant players in the global carbon market, moving from polluting economies to climate-positive economies.

While the Voluntary Carbon Market is still relatively new and evolving, it is clear that it holds tremendous potential for creating positive environmental and social impact. The market is shifting towards ensuring quality carbon credits and avoiding greenwashing, with increasing regulatory attention driving greater accountability and transparency.

The opportunity for energy-related SMEs, developing countries, and socially responsible businesses to thrive in this market is immense. Although challenges remain, the VCM is steadily moving towards a more ethical, sustainable future.

Take action today, contact us, whether you are a business looking to offset your emissions or a company wanting to get involved in carbon credit projects, the VCM offers an important opportunity to make a real difference in the fight against climate change.