As nations around the world seek to meet ambitious climate targets, Thailand has emerged as a leader in leveraging market-based solutions to transition towards a sustainable energy future. Among these solutions, carbon credits have become a pivotal tool. Thailand’s carbon credit projects are not only driving the country’s efforts to reduce greenhouse gas emissions but are also accelerating the deployment of renewable energy technologies. This article delves into how Thailand’s carbon credit mechanisms are helping unlock capital for renewable energy projects, creating a pathway for a cleaner, more sustainable future.

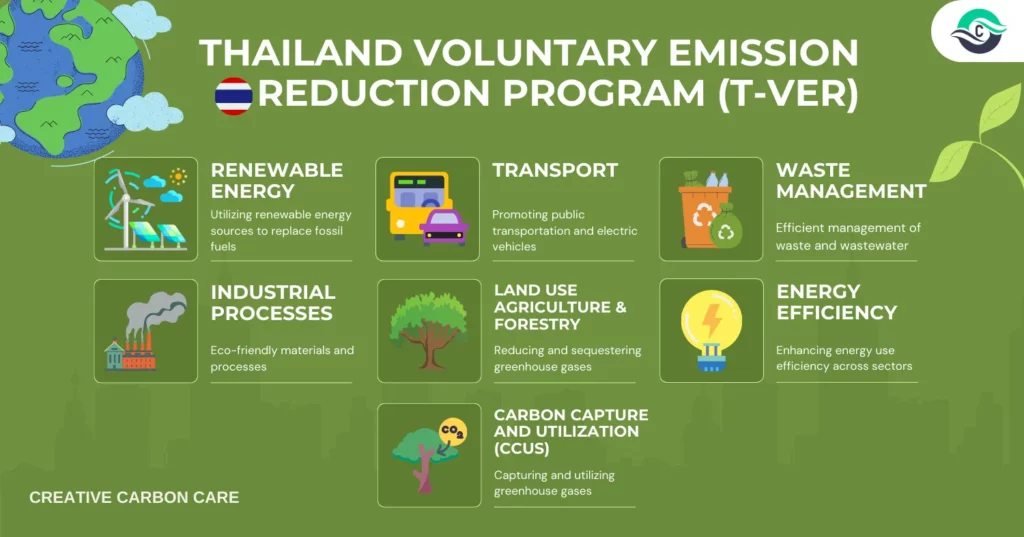

Thailand’s carbon credit market is grounded in both national and international frameworks. The Thailand Voluntary Emission Reduction (T-VER) program plays a central role, allowing businesses and government entities to earn carbon credits for emission reductions achieved through various projects, including renewable energy initiatives. The T-VER program and other carbon market mechanisms, such as Article 6 cooperation under the Paris Agreement, are designed to incentivize both domestic and international investments in renewable energy.

The T-VER program ensures that projects, such as wind, solar, and biomass energy generation, that are eligible for carbon credit issuance, meet specific criteria for emission reductions. In doing so, Thailand offers a robust certification platform that helps businesses and developers prove their impact on the environment while attracting investments needed to scale clean energy solutions.

Thailand’s carbon credit projects are not only creating a market for tradable carbon credits but also helping to bridge the financing gap for renewable energy projects. According to a UNDP report on Thailand’s energy transition, carbon credit systems are pivotal in attracting investments for large-scale clean energy projects, which traditionally require significant upfront capital. By monetizing emission reductions, carbon credits provide additional revenue streams that improve the financial viability of renewable energy investments, making them more attractive to developers and investors.

The Clean Energy Finance and Investment Roadmap of Thailand, published by the OECD, highlights the synergy between carbon markets and renewable energy. The report outlines how carbon credits from renewable energy projects, such as solar farms, wind energy installations, and bioenergy facilities, can generate new funding streams. These credits act as a form of climate finance that complements traditional financing mechanisms like green bonds or public investment, thereby facilitating faster energy transitions.

The Naresuan Hydropower Project is a renewable energy initiative in Thailand that harnesses the power of water to generate electricity. As a registered project under the T-VER program, it earns carbon credits for the emission reductions achieved by replacing fossil fuel-based energy with clean, hydroelectric power. These carbon credits provide an additional revenue stream, making the project more financially viable and helping offset the capital costs of development. This exemplifies how carbon credit systems can support large-scale clean energy projects, similar to other renewable energy projects in Thailand, by attracting investment and accelerating the transition to sustainable energy sources.

The mechanism of trading carbon credits, as explained in the OECD roadmap, enhances the financial flexibility of renewable energy developers. The carbon credit market essentially acts as a financial backstop, ensuring that investors receive a return on investment through the sale of credits, which are generated when a project reduces greenhouse gases. By integrating these credits into their project financing structures, developers can access funds that would otherwise be unavailable through traditional financing routes.

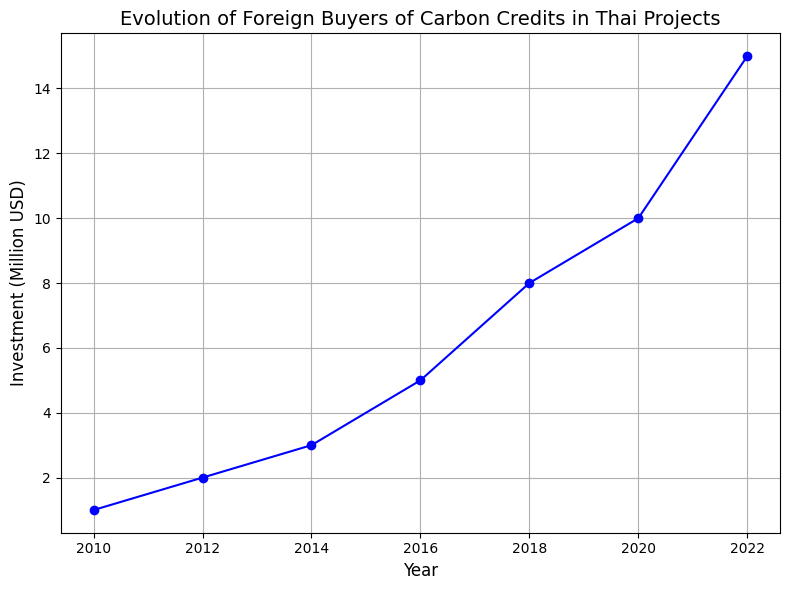

Thailand’s carbon credits also offer an added advantage: by linking with international carbon markets under the Article 6 of the Paris Agreement, Thai projects can sell their credits to buyers abroad. This broadens the pool of potential investors, making it possible to raise funds from international sources who are seeking to meet their own climate commitments.

In this way, the carbon credit market plays an indispensable role in creating a conducive environment for renewable energy deployment in Thailand, where both local and international stakeholders collaborate to meet the country’s energy transition goals.

While carbon credits are a powerful tool, their full potential in driving renewable energy development in Thailand is not without challenges. One major hurdle is the need for high-quality, transparent projects that can ensure accurate and verifiable emission reductions. As noted in the UNDP report on Thailand’s energy transition, project verification is key to maintaining the credibility of the carbon credit market. Without clear, consistent guidelines for measuring and verifying emission reductions, investors may hesitate to participate in the market.

However, the government’s commitment to expanding carbon credit markets and its cooperation with international organizations provides significant opportunities for growth. Thailand’s involvement in the Asia-Pacific Carbon Market and its ongoing efforts to align with global carbon market standards are positive signs of the country’s determination to harness the full potential of carbon credits. As the market matures, we can expect to see more renewable energy projects integrated into the carbon credit system, making Thailand an even more attractive destination for clean energy investments.

Thailand’s carbon credit projects are playing a pivotal role in accelerating the country’s renewable energy transition. By providing a financial incentive through carbon credits, these projects are helping unlock the capital needed to scale renewable energy technologies. The synergy between carbon credits and renewable energy not only supports Thailand’s climate commitments but also creates a model that can be replicated across the region. As the country continues to refine its carbon credit systems and expand international cooperation, Thailand is poised to remain at the forefront of the global transition to clean energy.

Take action today, contact us, whether you are a business looking to offset your emissions or a company wanting to get involved in carbon credit projects, the VCM offers an important opportunity to make a real difference in the fight against climate change.