Sustainability-Linked Loans (SLLs) hit $362 billion in 2022, offering borrowers incentives to meet sustainability targets tied to their interest rates. Nonetheless, challenges like data transparency and greenwashing remain. To address these, IoT solutions can provide real-time, reliable ESG data, ensuring genuine sustainability and that SLLs can truly empower positive environmental impact.

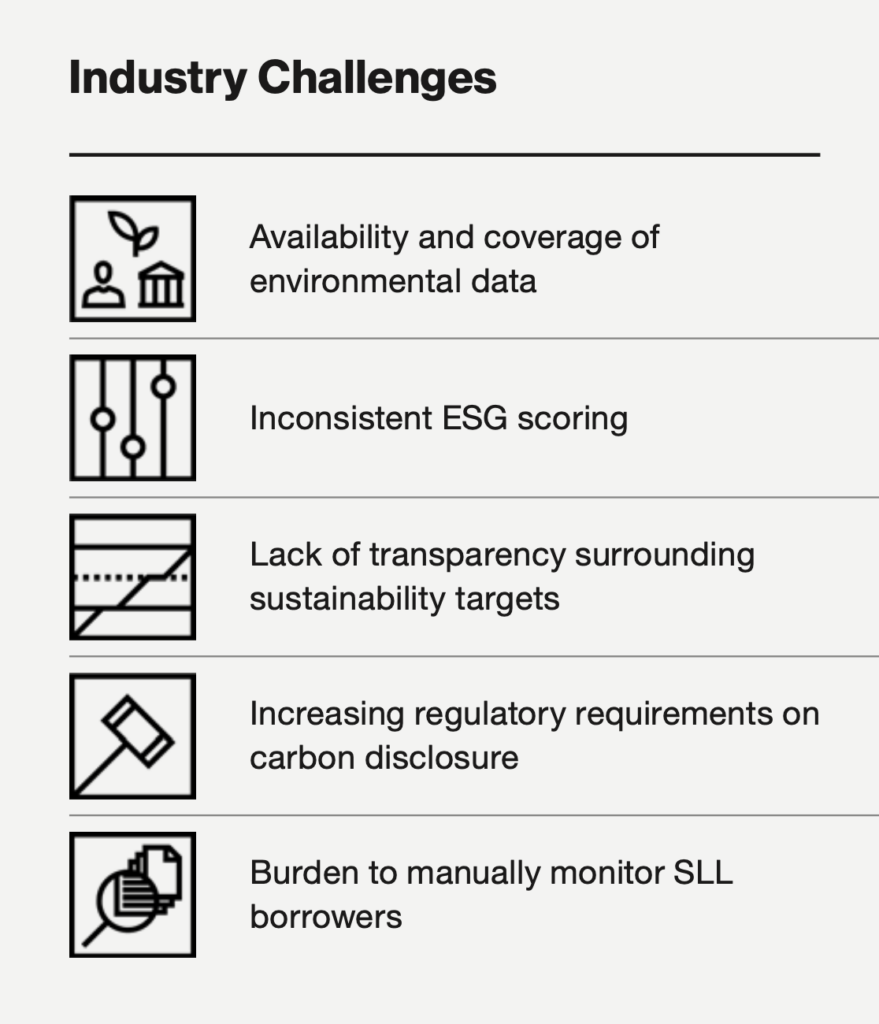

Sustainability-Linked Loans have seen remarkable growth, reaching $362 billion in 2022. These loans incentivize borrowers to achieve sustainability targets validated by independent ESG rating agencies or verification parties. By aligning the interest rates with sustainability performance, these loans encourage borrowers to enhance their ESG evaluation and engage in environmentally responsible practices, contributing to global environmental conservation. In the quest for a greener and more sustainable future, the financial world has embraced the concept of sustainable finance as a catalyst for positive change. However, amidst this transformative journey, various challenges have emerged.

As regulators worldwide emphasize the importance of climate risk-related data disclosures, the integration of IoT solutions becomes indispensable. IoT solutions hold the potential to revolutionize sustainable finance by providing a robust foundation of real-time, accurate, and comprehensive data. These solutions pave the way for informed decision-making, transparency, and offer a means to verify sustainability claims effectively.

Companies’ transition towards sustainability through instruments like SLLs is critical for global climate efforts. Overcoming these challenges requires collaborative efforts among financial institutions, regulatory bodies, and businesses to enhance data transparency, standardization, and monitoring practices to ensure genuine sustainability commitments and avoid greenwashing in sustainable financing initiatives.