Sustainable finance is rapidly evolving, driven by the urgent need to address ESG issues. However, despite its growth, significant data challenges persist that hinder effective decision-making and investment.

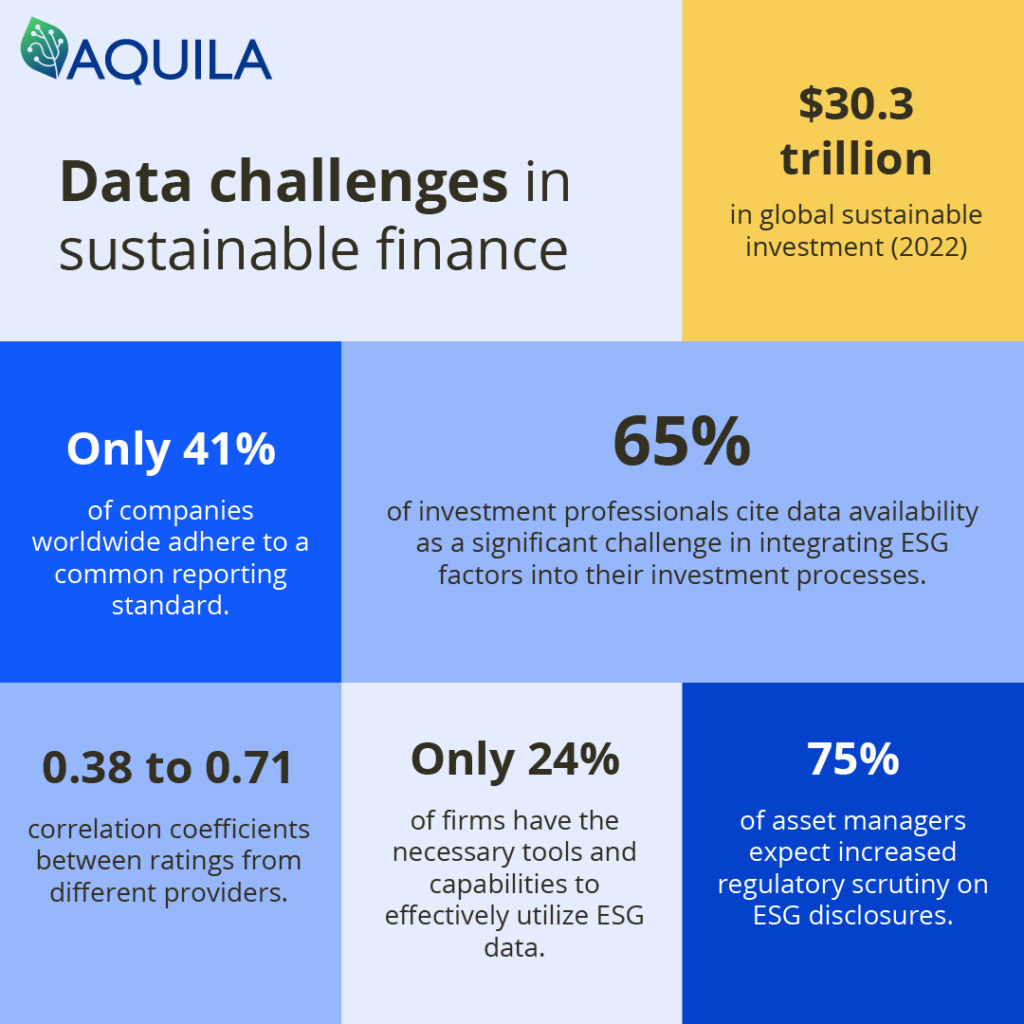

One of the core challenges in sustainable finance is the availability and quality of ESG data. A report by the Global Sustainable Investment Alliance (GSIA) indicates that global sustainable investment reached $30.3 trillion in 2022, showcasing a maturing industry with tighter definitions and standards to combat greenwashing. However, inconsistent and non-standardized data remain a significant barrier.

Different reporting standards and frameworks, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD), create confusion. A study by KPMG reveals that only 41% of companies worldwide adhere to a common reporting standard, leading to discrepancies in ESG data comparability and reliability.

The quality and accuracy of ESG data are often questionable. For instance, a 2021 study by MIT Sloan found that ESG ratings from different providers vary substantially, with correlation coefficients between ratings from different providers ranging from 0.38 to 0.71. This inconsistency makes it challenging for investors to assess the true sustainability performance of companies.

Access to comprehensive ESG data is limited. According to a survey by the CFA Institute, 65% of investment professionals cite data availability as a significant challenge in integrating ESG factors into their investment processes. Small and medium-sized enterprises (SMEs), which represent a significant portion of the economy, often lack the resources to provide detailed ESG disclosures, exacerbating the data gap.

Managing and analyzing ESG data requires advanced technology and expertise. A report by McKinsey highlights that only 24% of firms have the necessary tools and capabilities to effectively utilize ESG data. The integration of big data, artificial intelligence, and machine learning can enhance data accuracy and predictive analytics but requires significant investment.

Regulatory requirements for ESG reporting are evolving but remain fragmented across regions. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) is a step towards standardized reporting, but global harmonization is still a distant goal. According to PwC, 75% of asset managers expect increased regulatory scrutiny on ESG disclosures, necessitating robust data management systems.

Sustainable finance holds immense potential for driving positive change, but overcoming data challenges is imperative to unlock its full potential. As the industry matures, addressing these issues will be critical for informed decision-making and impactful investments.