-

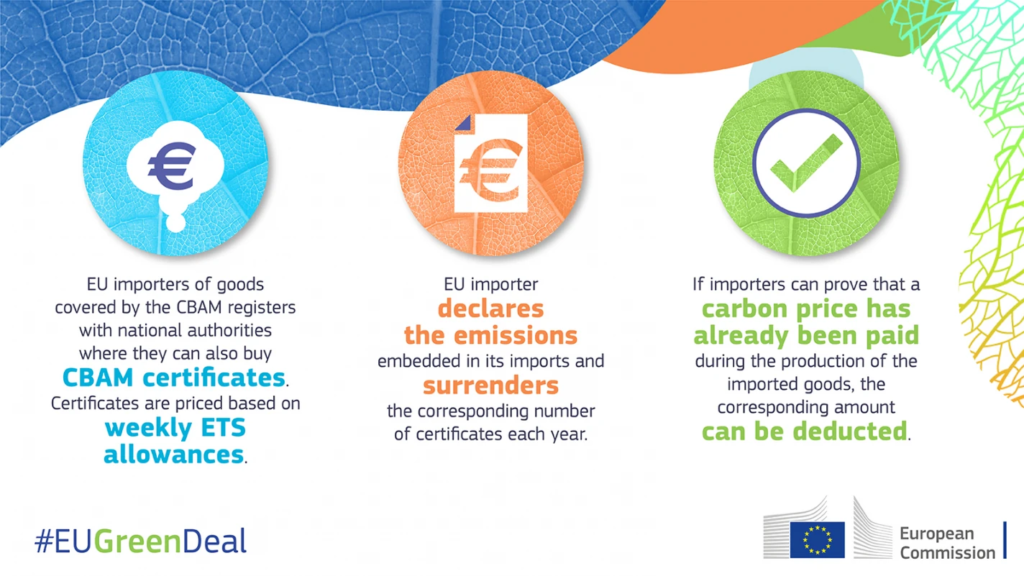

CBAM ensures that carbon-intensive goods imported into the EU, such as cement, steel, aluminium, and fertilizers, carry a carbon price equivalent to that of EU-made goods, preventing carbon leakage and promoting global environmental accountability.

-

The CBAM began its transitional phase on 1 October 2023, requiring importers to report greenhouse gas emissions without financial obligations. By 2026, a permanent system will be in place requiring the purchase of CBAM certificates based on emissions.

-

CBAM will phase in alongside the reduction of free allowances under the EU Emissions Trading System (ETS), and may expand to cover more goods by 2030, with reviews during the transitional period to refine its methodology and scope.