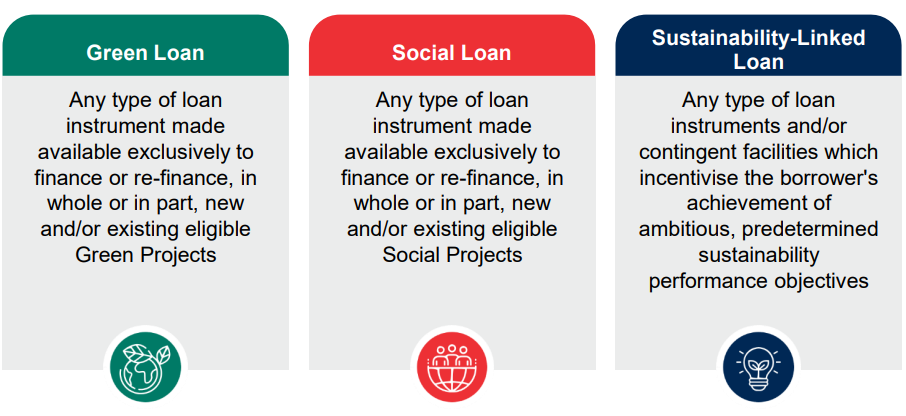

Unlike Green or Social Loans, Sustainability Linked Loans (SLLs) aren’t tied to specific projects; instead, their interest rates depend on the borrower’s achievement of pre-agreed Sustainability Performance Targets (SPTs), encouraging broader ESG improvements.

SLLs offer a dynamic pricing mechanism: Meeting ambitious sustainability targets can lead to lower interest rates, while failing to do so can result in higher rates, turning ESG goals into measurable financial incentives or penalties.

SLLs benefit both borrowers and lenders: Borrowers gain funding flexibility and enhanced reputation, while lenders align with ESG regulations and avoid falling behind in an increasingly sustainability-focused financial environment.